Would Google consider buying up Twitter? That's the question that's been gaining traction in recent months, and it's building momentum again today. A post by Mic Wright over on The Next Web laid out the case for Google to takeover Twitter, saying that: "Google should buy it, support it and let it grow into the social presence that Google+ will never be."

Would Google consider buying up Twitter? That's the question that's been gaining traction in recent months, and it's building momentum again today. A post by Mic Wright over on The Next Web laid out the case for Google to takeover Twitter, saying that: "Google should buy it, support it and let it grow into the social presence that Google+ will never be."

This is the most common angle, that Google should look to a Twitter acquisition to fill it's need for a social element, something they've been unable to successfully build (despite repeated attempts). Why not just buy a successful social ecosystem, fending off rising competition for audience attention from Facebook whilst also giving Twitter the freedom build their service without having to run the risk of turning their audience away via constant tweaks designed to get more users on board quickly? A win-win, right? But as Wright points out, one of the key stumbling blocks for any such deal is Twitter's likely asking price, which is probably still beyond the range that Google would feel comfortable with. But if the share price were to fall and remain low, maybe.

And then, today...

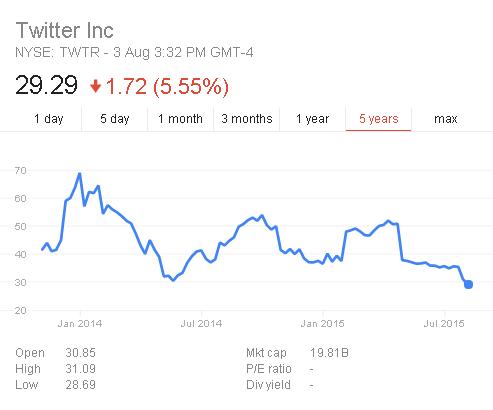

Twitter's share price fell to new, all-time lows, still reeling on the back of its most recent earnings report, in which CFO Anthony Noto noted of the mico-blog giant:

Twitter's share price fell to new, all-time lows, still reeling on the back of its most recent earnings report, in which CFO Anthony Noto noted of the mico-blog giant:

"We do not expect to see sustained meaningful growth in MAU until we start to reach the mass market. We expect that will take a considerable amount of time."

That sort of talk doesn't bode well for the future strength of the company - even though revenue was strong, it's growth that has Wall Street most concerned, and the efforts that Twitter may have to take to get more users in.

So if the share price remains low, could we see Google make an offer for Twitter? And what does that mean for both companies?

A New Dawn

It's no secret that Google has long wanted to add a social element to the wider Google experience. They launched Orkut in 2004 (days before Facebook) which was quickly overtaken by Zuckerberg's giant and eventually shut down in 2014. Google also launched the RSS-based Reader back in 2005, which was also shuttered in 2013. There's also been Google Wave and Google Buzz and probably several other variations that may or may not have been social networks in the making that never really got off the ground. Google+ was seen as a requirement within Google, a necessary measure to battle the rising threat of Facebook. By the time Google's social network was launched in 2011, Facebook was firmly on the rise and those within Google could see the threat the growing social behemoth could pose. With Google+, the view was that they would get social right and beat Facebook at their own game - basically by being better all-round. The mission was well-intentioned, but, of course, ultimately not to be.

With the demise of Google+ now playing out in full, Google is once again without a social layer, and is once again more starkly vulnerable to Facebook. Add to this the fact that Zuckerberg and co are attacking Google's dominance in online video (through YouTube) and that also, in Facebook's most recent earnings call, Zuckerberg specifically highlighted Search as a key area of focus and growth for The Social Network, and you can imagine that Google's leadership team would be feeling the pressure. Maybe not in terms of a head-to-head battle as such - Google's 2014 revenue was $66 billion versus $12.46 billion at Facebook - but in ongoing market share, Facebook is growing at a much faster rate (revenue growth at Facebook was at +58.36%, year-on-year in 2014, versus +19% year-on-year at Google). And while a differentiation in growth makes sense - Google's been in the market longer and has a higher base level to expand upon - Facebook is dominating attention online. The Social Network now has 1.49 billion monthly active users, with engagement among those users coming in at 46 minutes per day, on average. Facebook's also winning in the increasingly crucial app stakes, with Messenger, WhatsApp and Instagram regularly beating out all comers in terms of downloads and engagement. And we haven't even mentioned Google's losses in display advertising to the rising challenge of social media networks.

Make no mistake, Google is feeling the heat on social. They could ignore it, of course, they could stick to search and hone their periphery focus onto virtual reality, dog robots and driverless cars, but turning a blind eye and letting Facebook systematically take over the internet is not in their best interests, long term. Google need to remain competitive in order to maintain market positioning, dropping out of the social race could be the fatal flaw that comes back to haunt them over and over. This is why they've thrown so much money behind trying to stay in touch with the social trend, despite repeatedly seeing those efforts fail (Google+, at peak, reportedly had more than 1,000 staff working on the project).

A Bird in the Hand...

So, given this scenario, does a Google acquisition of Twitter make sense?

Google buying up Twitter doesn't immediately change the destiny of the micro-blog network, they'd still want to boost user growth, ongoing, to remain a viable company, but partnering with Google would take the pressure off, to an extent. Alleviating growth concerns, even a little, would better enable Twitter to focus on what they do best and not be as concerned about pushing hard on changes could might alienate long-time users, and might not bring in new users either way. As part of Google's family, Twitter would be able to focus on maximizing what they have, rather than adding new additions in an effort to bring what they don't, a focus which could increase its long-term viability.

What's more, Twitter brings Google more data. While Twitter and Google already have an arrangement in place to share Twitter's firehose of real-time tweets with Google, the full integration of Twitter's data into the Google experience would still be a significant change. Google could utilize Twitter's data insights to improve ad targeting, while integrating Twitter's ad offerings into their existing AdWords platform, which would expand the potential of Twitter's advertising system. No one, arguably, knows online advertising better than Google, so who better to take control of Twitter's ad platform and ensure it's being maximized for all it can be?

Integrating Twitter data more comprehensively into the Google search experience would also seem like a win-win. Tweets get more exposure, while Google gets more real-time, conversational data to use in its ranking algorithm, helping it compete with Facebook's potential search offerings - how much tweet content could be built into Google's search algorithms under the current Twitter/Google deal is unknown, but they'd securely be able to rely on that data-source if they were to own it.

Google News, too, would benefit from Twitter's position as the leader in real-time event coverage - not only would you get all the latest info from Google's existing news resources, you'd also have live tweet, Periscope and Vine matches highlighted within your news search. In this sense, Twitter's strengths definitely compliment Google's and would well place the combined entity to go head-to-head against Facebook.

And the bigger query - would it make financial sense for Google to buy Twitter? Despite slowing growth, Twitter is still making money - second quarter revenue rose 61% to $502.4 million, and there's still significant potential for more.

There's obviously a wide array of factors that can either facilitate or de-rail any potential Google/Twitter partnership, but the logic of such a union, at least on the surface, does make some sense. Interestingly, some analysts have suggested that recent comments from Twitter management about lower expectations for growth and ad potential, made in their Q2 earnings call, could be part of a deliberate strategy to position the company for a takeover - some are even advising clients to hold Twitter stock on the expectation that a takeover is imminent.

However it plays out, speculation looks set to continue in the immediate term and it's definitely an area all social media industry-types should be watching - any such move could trigger a seismic shift in the wider social landscape.